The financial wellbeing

online course

Finally - a finance course that meets you where you’re at!

Whether you're working through your financial goals on your own, or accessing this course through your workplace's wellbeing program, you're in the right place.

The Money Collective's Online Financial Wellbeing Course is designed to help everyday Australians build clarity, confidence, and capability with money — one step at a time.

This is not about budgeting harder. It’s about, shifting habits, being deliberate with all your money to create a system that works for you.

The 12-step framework that guides the course

Our online course is structured around The Money Collective’s proven 12-Step Financial Wellbeing Framework — the same framework we use in our coaching, workshops, and workplace programs.

You'll explore topics like money mindset, habits, planning, goals, and financial systems — all in a way that’s simple, relevant, and ready to apply to your life

Each step includes:

A short video (10–15 mins)

A downloadable worksheets

Spreadsheets and templates to help you take action and build your new money system

You can work through the course at your own pace, in your own time.

Is this course for me?

This course is for you if:

You want to set up a new system for your money to hit your financial goals

You want to learn about your current money behaviours to change your habits and live a life that you value

You're ready to feel better about your money

You want practical tools, not financial fluff

You're navigating money decisions alone or with a partner

You’ve never had a financial education — or you’re looking for a reset

Whether you’re in your 20s or 60s, renting or buying, single or coupled — the course adapts to your life stage.

How to access the course

The Money Collective Financial Wellbeing Program - 12 months access

For Individuals

Sign up now to get lifetime access for just $249AUD. Start today and begin creating a financial system that works for your life.

For Employees in a participating workplace

If your employer has partnered with The Money Collective through the Financial Resilience Program, you get access for free.

Use your workplace code at checkout to unlock the course. To register for the course, click the “let’s do this” button above.

Don’t have your code? Contact us and we’ll help you get started.

“This course is a fantastic guide to your financial independence. It is comprehensive, practical and very relevant, no matter where you are in your journey towards financial freedom.”

“How my spending habits were an exact reflection of my childhood money stories. I got mixed signals of saving and spending, of money being important and irrelevant. So, my spending personality oscillates between saver, spender and risk taker.”

“Money was just confusing and too much, I never wanted to think about it until I had to when we split. But now, doing this course showed me it can be pretty straightforward.”

What you’ll walk away with

By the end of the course, you’ll have:

A personalised, automated system for managing your money

A clear understanding of your financial priorities and values

A spending plan that’s realistic, sustainable, and aligned with your goals

The tools, mindset, and confidence to make informed financial decisions — without the overwhelm

This isn’t about being perfect with money. It’s about building a system that works for your real life, and feeling good about where you’re heading.

Go at your own pace to:

Watch the videos

Complete the worksheets and spending plan

Create your personal financial wellbeing Plan

Set up a new system for your money

How can I be sure it will work for me?

There’s no guarantees, but we do know that you get out what you put in. If you’re willing to do the work to see the results, you will. You are the biggest determinate of this course ‘working’, so give it your best.

If you need additional support, you can always book in a one-on-one chat with a money coach to get you moving in the right direction.

Inside you’ll have the ability to book:

free 20 minute chat with a financial wellbeing coach

free home loan advice session with a qualified TMC mortgage broker

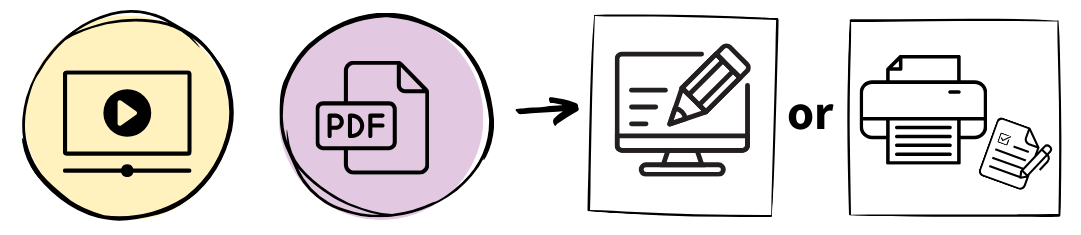

What device can I use?

We recommend using a laptop or desktop computer to do this course because it is easier to complete the worksheets and Spending Plan on a larger screen size. Although you can always opt to print them off from your mobile and complete them on paper if you don’t have a computer available.

Who made the course?

Mel and Darlene have over 50 years experience in the finance industry, and have worked with thousands of people. This course has been built to bring all their knowledge and experience into one place and share their passion for truly seeing people thrive.

Meet Mel

“I’m passionate about truly guiding, informing, and supporting people to understand, be confident, and feel good when it comes to their money.”

With 20+ years in the finance industry and her first mortgage broking business established at 21 years of age, Mel has earned her banking and lending experience with Peoples Choice Credit Union, NAB, and RAMS Home Loans and has been a qualified Australian Credit Representative since 2004, and accredited member of the Mortgage and Finance Association of Australia. As a member of Women Supporting Women in Finance Group, Mel developed a unique perspective in the industry and respected voice in the finance community, and she is committed to empowering people when it comes to their money.

Meet Darlene

“I’m passionate about empowerment and gender equality. I want to smash the taboos, showing you how easy and comfortable it can be to talk about, use, manage, and plan with your money. It doesn’t need to be stressful, influence our emotions or be a negative force we must control. Money isn’t the end goal, it’s an enabler that simply brings increased choice.”

With an MBA and 30+ years in the finance industry, Banking and lending, Darlene owned RAMS Home Loans Maroondah Yarra Ranges franchise for 5+ years. She is a Qualified Mortgage Broker - Australian Credit Representative since 2014 and an accredited member of the Mortgage and Finance Association of Australia since 2014. She has led the MFAA Victoria/Tasmania State forum group since 2021, and held positions of Chair, Vice Chair and an active board member for a disability support NFP for 10+ years.

The Money Collective Financial Wellbeing Program - 12 months access

Begin your journey now!

Compound the positive impacts of your time and energy into uplifting your financial health and wellbeing now.

“The online course helped me confront my spending patterns and helped me highlight where my spending was excessive. I liked the way the course helped me answer some home truths and family patterns that have influenced me with my spending habits.”

“The excel spreadsheet was my favourite. It was clear and easy to use. I have used 4 other spreadsheets similar to this and this was by far the best. To see our figures on paper ACTUALLY GOT ME REALLY EXCITED.

I Love it. Very clear. The formulas all worked and gave me a great understanding of where we are at. I would use this every 6 months.”

“This course helped consolidate my knowledge and understanding, also helping me plan out a course with the help of the worksheets.”

“It gave me a more planned approach to reaching my financial goals.”

How easy is the course to do?

“I do feel compelled to continue. It’s like opening a pandoras box and but also one that you want to know what’s in it. Its empowering feeling like you are taking control of your finances rather than being swept along by companies and financial institutions.”

“I completed the first 5 steps easily without a break, the content is excellent. Step 6 requires more time to do... I did not feel like skipping any of them.”

“The videos, text and worksheets worked well together and I feel like they can accomodate someone like me who is an oral and visual learner. Slabs of writing don’t work for me but when coupled with engaging video content, the elements work well together.”

“The information is presented in a clear and concise manner. Everything is easy to find and navigate through. There is a clear pathway for the entire course.”

It’s time to make positive change

Don’t wonder what life would look like if you were doing it differently when it came to money. Now is the time to initiate something new, so you can start seeing the compounding benefits from being more confident and having a written plan.

The Money Collective Financial Wellbeing Program - 12 months access

Don’t think you are ‘ready’ yet?

That’s okay!

Join our Facebook Community, check out our Premium Personal 1-1 Coaching, read more about Our Story, or Meet The Team.

Message us and stay connected

Subscribe to our financial wellbeing mailing list for information, news, and to be invited to upcoming events. We don’t believe in spam and only email sparingly about things that matter to financial wellbeing.